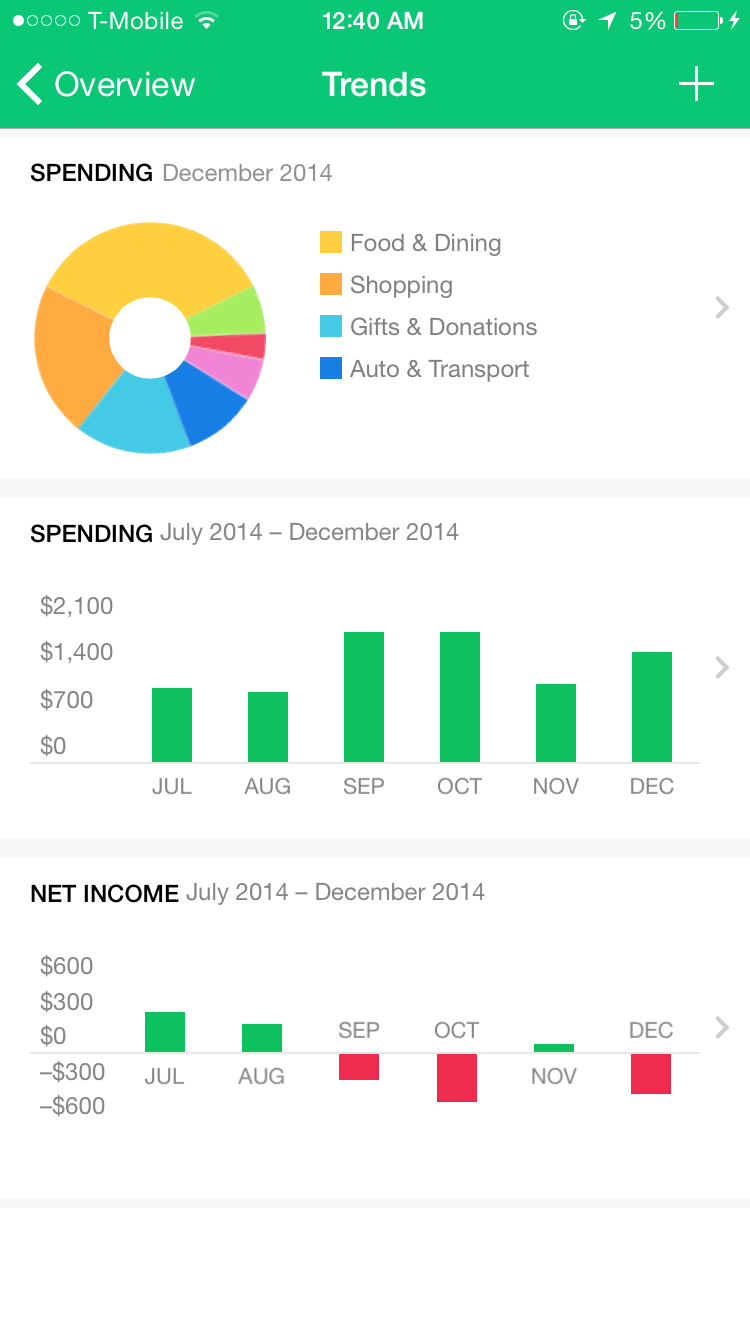

That said, you can manually enter transactions, which is helpful if you tend to receive cash and spend it without ever putting it into an account. The site is fairly useless if you don't agree to connect your financial accounts, since Mint uses this data for everything. These connections allow Mint to pull all the line item transactions from all your accounts so you can see exactly where and when you spent money or earned it. Mint offers a feature tour when you create your account, then it launches right into requesting usernames and passwords for your banking, credit card, and other financial accounts. Since 1982, PCMag has tested and rated thousands of products to help you make better buying decisions. Everything that has made Mint a PCMag Editors' Choice winner for so many years continues today. Mint's mobile apps continue to be exceptional. The new design isn't as effective as the old one, which accounts for Mint's score dropping from a 5 out of 5 to 4.5, though it's not objectively bad. Since our last review, Mint has seen an overhaul of its user interface, with the goal of improving responsiveness, navigation, and usability. Mint's developers continue to leverage machine-learning technology (AI) to provide a smarter, more personalized, more automated experience that features deeper insight and intelligence. Furthermore, Mint is free, making its money by displaying targeted ads for credit cards and other finance products.

It lets you connect to all your online finance accounts, check your credit score, and get a good estimate of your net worth, among many other financial management tasks. Mint is an exceptional personal finance service that has won multiple Editors' Choice awards thanks to its simplicity, usability, and smart financial tools.

How to Set Up Two-Factor Authentication.How to Record the Screen on Your Windows PC or Mac.

0 kommentar(er)

0 kommentar(er)